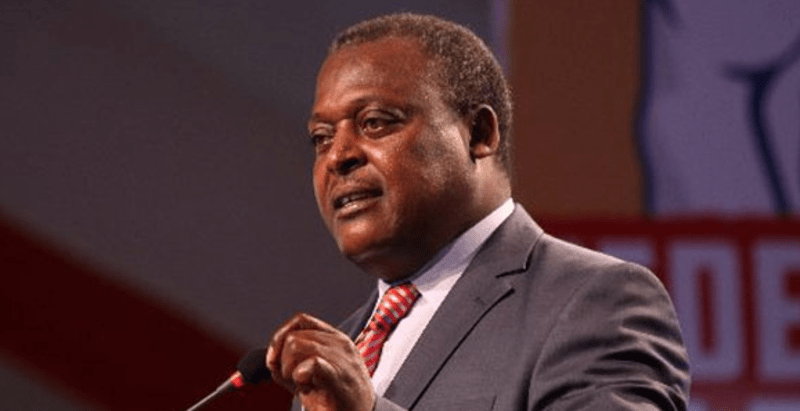

Kiharu MP Ndindi Nyoro raises alarm over rising debt, warns of possible default

Speaking at the Institute of Public Finance’s annual budget review on Tuesday, Nyoro expressed concern that the country’s debt, now standing at Sh11 trillion, could soon lead to Kenya joining Africa's debt-defaulter ranks.

Kiharu Member of Parliament Ndindi Nyoro has sounded the alarm over Kenya’s growing public debt, warning that the country is on the verge of defaulting on its obligations.

Speaking at the Institute of Public Finance’s annual budget review on Tuesday, Nyoro expressed concern that the country’s debt, now standing at Sh11 trillion, could soon lead to Kenya joining Africa's debt-defaulter ranks.

More To Read

- Ndindi Nyoro questions government’s decision to sell 15 per cent Safaricom stake

- MPs propose part-time roles for TSC chair, commissioners to save Sh70 million annually

- Parliamentary Budget Office warns Sh2.2 trillion projects at risk over funding delays

- CS Kinyanjui: Kenya cannot develop while rejecting all funding options

- Kenyan CEOs warn of tough times as high costs, taxes squeeze businesses

- Government’s increased revenue strategy faulted amid missed targets, public backlash

The MP’s warning comes as the country grapples with a growing debt crisis that has seen Kenya’s public debt skyrocket from just under Sh2 trillion a decade ago to the current Sh11 trillion.

According to figures from the Central Bank of Kenya, as of December 2024, the country owes Sh10.9 trillion to its creditors, with 54 per cent of this debt owed to local lenders and the remaining 46 percent to external creditors.

Nyoro, who previously chaired the National Assembly’s Budget and Appropriations Committee, cautioned that attempts to renegotiate the debt could worsen the situation, potentially destabilising the country’s financial standing in the global market.

“Any indication that we are going to default or are unable to service our loans is more catastrophic to our economy,” Nyoro said, underlining the risks of any efforts to restructure the nation’s debt.

President William Ruto will travel to China, where discussions regarding Kenya’s debt challenges are expected to be a key topic.

This follows Kenya’s mission to China seeking debt restructuring.

Nyoro warned that renegotiating debt terms would signal trouble to international lenders and financial markets.

As Kenya prepares for the 2025/2026 budget, Nyoro highlighted the country’s growing reliance on borrowing to finance the budget deficit.

The National Treasury plans to spend Sh4.2 trillion in the upcoming financial year, with Ksh.1 trillion earmarked for debt interest payments alone.

Of this amount, Sh750 billion will go towards servicing domestic debt, and Ksh.200 billion will be used to pay off external debt.

Nyoro also pointed out that the government’s increased tax burden since 2022 has added to the economic strain.

“Increasing taxes to get more revenue is a fallacy. By increasing taxes, you distort economic decisions,” he said, criticising the impact on consumer behaviour and overall economic growth.

Top Stories Today